are 529 contributions tax deductible in south carolina

If you file a South Carolina tax return either as a resident or a non-resident you may be eligible for additional tax advantages. New Mexico Virginia and West Virginia.

The News Is Here Accountfully Has Expanded Its Services Tools And Resources To Better Serve Financial Information Bookkeeping And Accounting Press Release

You can contribute up to 15000 per year 30000 for married couples.

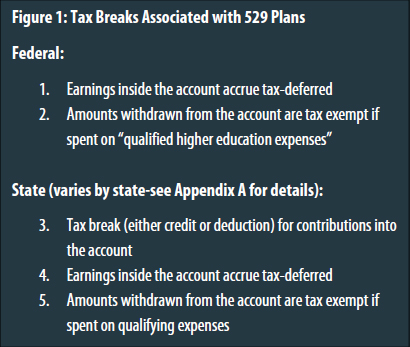

. Georgia Iowa Mississippi Oklahoma and Wisconsin are the others. This means that South Carolina taxpayers can deduct any amount they contribute to an SC 529 plan as long as they have the income to deduct. Contributing to a 529 college savings account can offer tax advantages including tax-deferred growth and tax-free withdrawals for qualified education expenses.

There can even be multiple accounts for the same child as long as all combined contributions across these accounts do not exceed 520000 in South Carolina. But you may be wondering if you can also get a 529 tax deduction. Yes south carolina taxpayers can claim a tax deduction on the full amount of their 529 plan contribution.

Contributions to 529 college savings plans are made with after-tax dollars. Most states limit the amount of annual 529 plan contributions eligible for a state income tax. The 1099-Q for the 529 plan deductions is entered in Deductions and Credits.

Future Scholar account contributions may be tax-deductible up to the maximum account balance limit of 52000 0 per beneficiary or any lower limit under applicable law. If you invest 1000 and earn 5 during a year youre not taxed on the 50 you earned. 529 plan accounts accept only cash contributions so assets in a Coverdell account must be liquidated first to make the transfer.

100 of contributions are deductible but do you deduct a proportional amount from income each year or can you deduct the entire amount in the year the contribution is made. You have until May 17 2021 to contribute and still get a break on your 2020 tax bill if you file a South Carolina tax return. There is no time in which the funds within a South Carolina 529 plan need to be withdrawn.

South Carolina How to deduct frontloaded 529 contributions for state income tax purposes. For most taxpayers there is no requirement to hold funds in a 529 plan for a specified amount of time before claiming a state income tax benefit. While the tax attributes of a 529 plan are like a Roth IRA 529s allow for much more hefty annual contributions.

For 2019 that amount is 15000 per student per year. South Carolina only allows residents to participate in their plans. If a married couple agrees to gift splitting this amount doubles to 30000 per student per year.

South Carolina residents who contribute to the states 529 plan receive an unlimited state income tax deduction. In Colorado New Mexico South Carolina and West Virginia 529 plan contributions are fully deductible in computing state income tax. Here are thedirections for 1099-Q.

Kentucky Maine New Jersey and North Carolina currently have state income taxes but do not offer a state income tax deduction or tax credit for contributions to the states 529 college savings plan. The growth of your account isnt taxed either. Yes South Carolina taxpayers can claim a tax deduction on the full amount of their 529 plan contribution.

While more than 30 states including the District of Columbia offer some sort of state income tax deduction for qualifying 529 plan contributions South Carolina is just one of six that allows families to claim a prior-year tax deduction up until the tax filing deadline. In your South Carolina return look for the screen Heres the income that South Carolina handles differentlyThe Education section should be right below RetirementSee Screenshot 1 belowIf you do not see the Education section there look up under the screen title. Yes you read that correctly.

Since contributions can add up to 500000 per beneficiary thats a high threshold. You also get federal income tax benefits as you do not pay income tax on your earnings. Only three other states allow for 100 of contributions to be claimed.

5 tax credit on contributions up to 4080 for joint accounts. There is no minimum contribution. Tax Benefits of 529 College Savings Plans.

Out-of-state participants still get the federal tax benefits. Withdrawals from a 529 plan are exempt from taxes when funds are used for qualified expenses such as tuition books housing food computers and supplies. What happens to a South Carolina 529 Plan if not used.

Although contributions are not deductible earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out to pay for college. South Carolina offers tax deductions and credits to reduce your tax liability including a. Most 529 plans allow participants to deduct part or all of their contributions on their income taxes and contributions to the SC Future Scholar.

If you get a 10 credit for up to. Good news for South Carolina residents by investing in your states 529 plan every dollar contributed can be deducted from your adjusted gross income. South Carolina taxpayers can deduct 100 of their contributions on their state tax returns.

Contributions to a South Carolina 529 plan are fully deductible - no limit. The limit is equal to the annual gift tax exclusion amount. Here are the special tax benefits and considerations for using a 529 plan in South Carolina.

Contributions to a single beneficiary across all 529 accounts cannot exceed 520000. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for education. In fact South Carolina is one of six states where you can still make a contribution to the state administered 529 plan Future Scholar and claim a deduction for the prior tax year up until you file your tax return.

Alaska Florida Nevada South Dakota Tennessee Texas New. The state income tax rates range from 0 to 7 and the sales tax rate is 6. If youve opened the Education screen before it may appear at the top for easy reference.

This is a percentage of your 529 contribution that directly reduces your state income tax bill. The maximum aggregate contribution limits vary by state. When you withdraw money to pay for qualified expenses you pay no South Carolina state.

While no federal tax break exists for deducting 529 plan contributions you may be able to claim a deduction or tax credit at the state level.

College Savings Planning Calculator Scholars Choice Nuveen

Treasurer Curtis Loftis On The Unique Benefits Of Future Scholar Sc Office Of The State Treasurer

Pre Tax Funding For College Education Under The Tax Cuts Jobs Act Clark Nuber Ps

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Should 529 Plans Be Owned By Parents Or Grandparents Cassaday Company Inc

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

How To File An Amended Tax Return Forbes Advisor

Pin By Sri Kriti On Read Turbotax Tax Return Good Listener

10 Simple Tips For Funding A 529 Plan Forbes Advisor

529 Accounts In The States The Heritage Foundation

Do I Have To File Income Tax Returns This Year Honolulu Star Advertiser

Arizona State Taxes 2022 Tax Season Forbes Advisor

/cloudfront-us-east-1.images.arcpublishing.com/gray/PBOQRWRU6FG4PBRA6MWFL33B3U.jpg)

Sc Babies Born On May 29 Eligible To Receive 529 For College Savings

Hanes Hall Unc Chapel Hill Unc Chapel Hill College Counseling Campus

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

Oregon State 2022 Taxes Forbes Advisor

Treasurer Curtis Loftis On The Unique Benefits Of Future Scholar Sc Office Of The State Treasurer